The PIP, Lot, and Order are some of the most important terms that all traders will get to know. With the help of these basic terms, the trader will able to get a profitable trade to boost their earning. In this article we are going to tell you the basic understanding of the important terms that will be used in forex trading:

PIP (Point In Percentage)

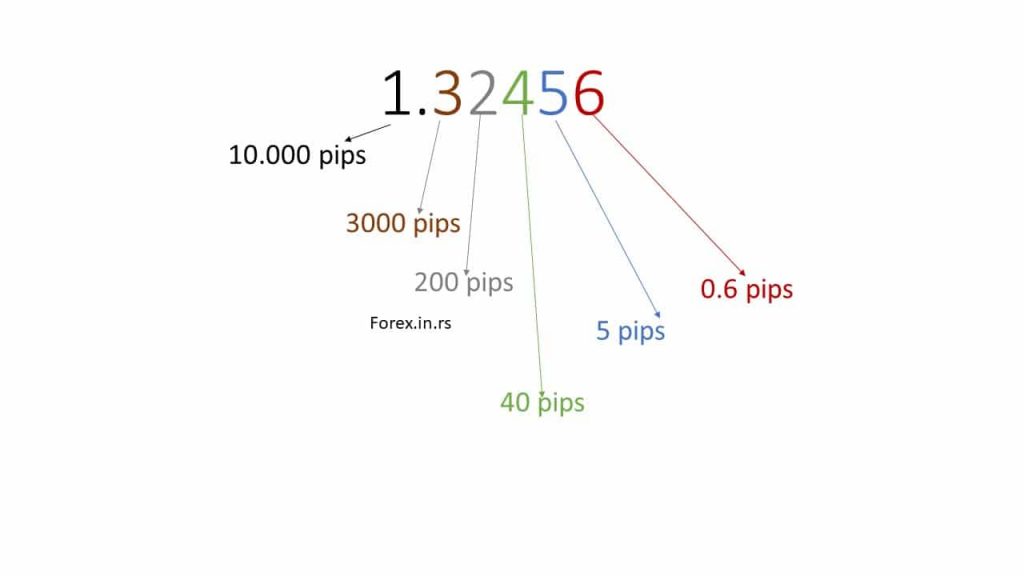

The PIP stands for the Point In Percentage that will be used to measure the difference between the two currency pairs. This will be represented by the single point that moves to the fourth decimal place in the forex quote.

In any case, not all forex cites are shown along these lines, with the Japanese Yen being the high release. Continue going to discover more about pips and how they’re used in forex trading, with models from chosen significant currency pairs.

How to Calculate Pip Value?

The PIP value is calculated by multiplying the one pip to the specific value lot/contract size. The lot size will be 100,000 units of the base currency and if we put the mini lot this is 10,000 units. Let’s take the example EUR/USD have the one pip movement in the standard contract size is equal to the $10(0.0001* 100000).

Having the option to figure the estimation of a solitary pip helps Best Forex Broker put currency-related an inspiration to their take benefit targets and stop-loss levels. Rather than basically breaking down developments in pips, brokers can decide how the estimation of their trading account (value) will vacillate as the exchange market moves.

It’s essential to take note that the estimation of one pip will vary for various money sets. This is on the grounds that the opinion of one pip will consistently have appeared in the currency of the statement/variable currency and this will vary when trading diverse currency pairs. When trading EUR/USD, the estimation of one pip will be shown in USD, when trading GBP/JPY, this will be in JPY.

ORDER

Orders are basic devices for traders and ought to consistently be viewed as when executing against a trading technique. Requests can be used to go into a trader just as, help ensure benefits and cutoff drawback hazard.

Understanding the contrasts between the order types accessible can assist you with figuring out which requests the best suit your requirements and are most appropriate to help you with arriving at your trading objectives.

Here are some of the Trading order that will help the trader to place the trade:

- Market Order

- Limit Order

- Stop Order

Market Order

A market order in forex trading is the most essential order type and is executed at the best accessible cost at the time the order is gotten.

Limit Order

A Limit order is an order to buy or sell at a predetermined cost or better. A sell limit request is filled at the predetermined cost or higher; buy limit orders are executed at the predefined cost or lower.

Limit orders permit you the adaptability to be exact in characterizing the section or leave purpose of an trade. Remember that breaking point orders don’t ensure that you will go into or leave a position, in such a case that the predetermined cost isn’t met, your request won’t be executed.

Stop Order

A stop order triggers a market request when a predefined rate is reached. A purchase stop request triggers a market request when the offer cost is met; a sell stop request triggers a market request when the offer cost is met. Both stop orders are executed at the best accessible cost, contingent upon accessible liquidity. Stop orders likewise called stop-loss orders are much of the time used to restrict drawback risk.

LOT In Forex Trading

A great deal in Forex trading is only a particular total of assets being utilized for trade. Fortunately, there are numerous sizes of parts that traders can use.

Contingent upon the organization a trader is using, the person in question could have their trade size named either 1 standard FX part size or 10 smaller than normally estimated lots you can put in Forex Trading MT4 Free Download.

The most mainstream sorts of parcels in Forex are standard size parts. This is the blend of 100,000 units of a particular currency. In this way, if a broker opens a trade worth $100,000 that implies that they are trading one standard-sized part for USD/EUR or some other cash pair with USD in it.

The sizes are partitioned this way:

- Standard lot – 100,000 units of currency

- Mini Lot – 10,000 units of currency

- Micro Lot – 1,000 units of currency

- Nano lot – 100 units of currency